Last updated: 29th March 2025

Written by: VAT Calculators

Looking for the latest VAT related statistics? Our resource is created and maintained to be easy to use, and up to date. You can be assured that any statistic in our repository is current, hand curated by our CEO Oliver Smith, and designed to be as clear to understand as possible.

We have requested the current number of VAT registered businesses in the UK directly from HMRC, and are still awaiting Q2, Q3, Q4 2024, and Q1 2025 data.

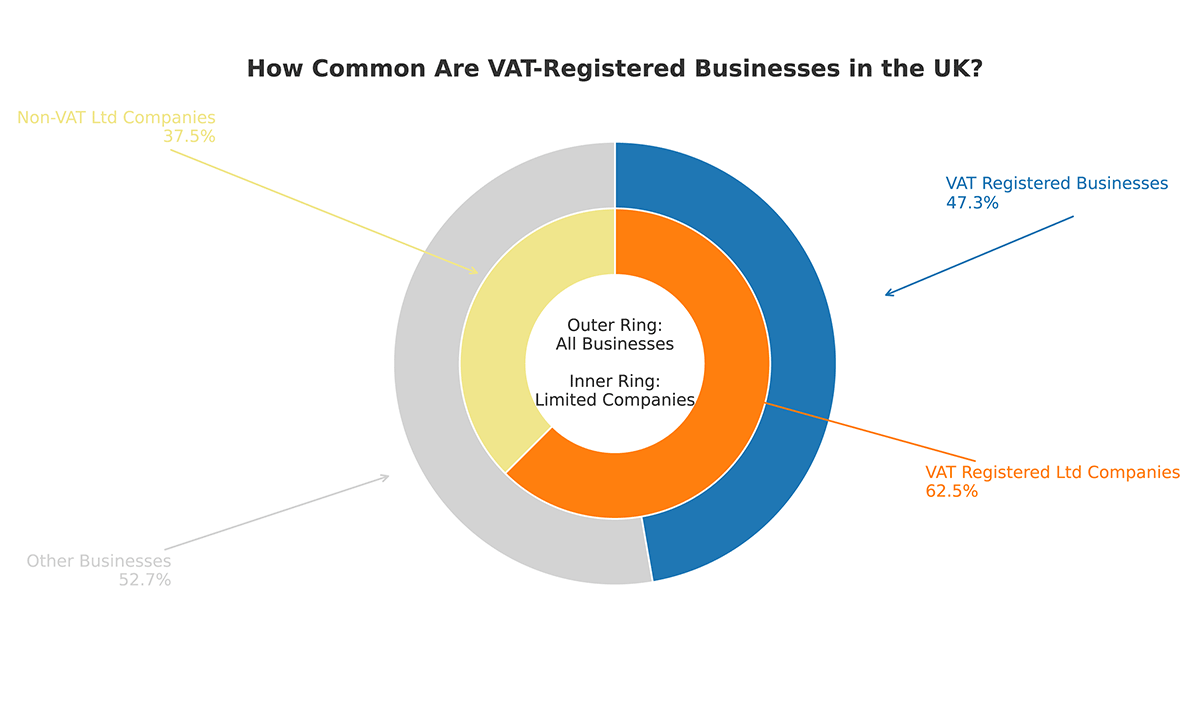

However, the most up to date available is from March 2024 and shows 2.725 million VAT registered UK companies.

A decline of 1.55% from it's peak in 2022, and a drop of 0.08% from 2023.

A lot of businesses and side hustles were created during covid which explains the rise from 2019 lows, and with current high inflation, rising interest rates, and reduced consumer spending have contributed to a lot of these entities going bust, or deregistering for VAT.

High inflation, rising interest rates, and reduced consumer spending have led to many closures, VAT defaults, and insolvency.

Energy costs and supply chain issues have put extra pressure on already struggling businesses. These excess costs are starting to normalise as of March 2025.

To gain a competitive advantage, some businesses might opt to stay below the VAT threshold (£90,000) or split their companies into multiple ventures, to avoid VAT registration.

Some smaller exporters or importers may have closed or shifted operations outside the UK due to increased friction in trade, bureaucracy, or cost pressures stemming from Brexit.

An increasing number of people may be operating informally or through gig platforms (e.g., freelancing, delivery apps) without reaching the VAT threshold or choosing to stay unregistered for simplicity.

If you're currently trying to workout if going VAT registered is a good idea, you can use our VAT calculator tool to workout your new prices and see how much you can claim back.

London: Leading the regions, London had 530,815 VAT and/or PAYE-based enterprises in 2024.

South East England: Followed with 437,045 enterprises.

Micro-Businesses (0-4 employees): In 2024, there were over 2.12 million VAT/PAYE enterprises in the UK with between zero and four employees, highlighting the predominance of small businesses.

Professional, Scientific, and Technical Sector: This sector remains the largest industry group, accounting for 15.2% of all VAT registered businesses in the UK as of March 2023.

Retail Sector: The number of retailers (excluding the motor industry) declined by 12.7%, equating to a loss of 42,450 businesses in a year. Despite this, the retail sector contributed £16.4 billion in VAT receipts, representing over 9% of the total VAT collected by HMRC.

Sources